We’ve been here before.

Maxam Diversified Strategies – Q4 2022 Commentary

Dear fellow investors,

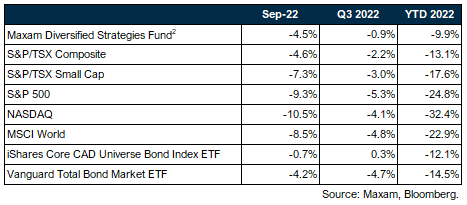

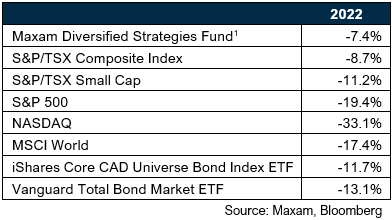

The Maxam Diversified Strategies Fund1 gained +2.8% in the fourth quarter and declined -7.4% in 2022.

The market environment faced downward pressure in 2022 from a multitude of factors – including high inflation, rising interest rates, recession fears and geopolitical tensions. The most dominant factor was the relentless efforts by central banks to crush surging inflation via tightening monetary policy. Most notably, the U.S. Federal Reserve raised interest rates seven times during 2022, taking the federal funds target rate to its highest level since 2007.

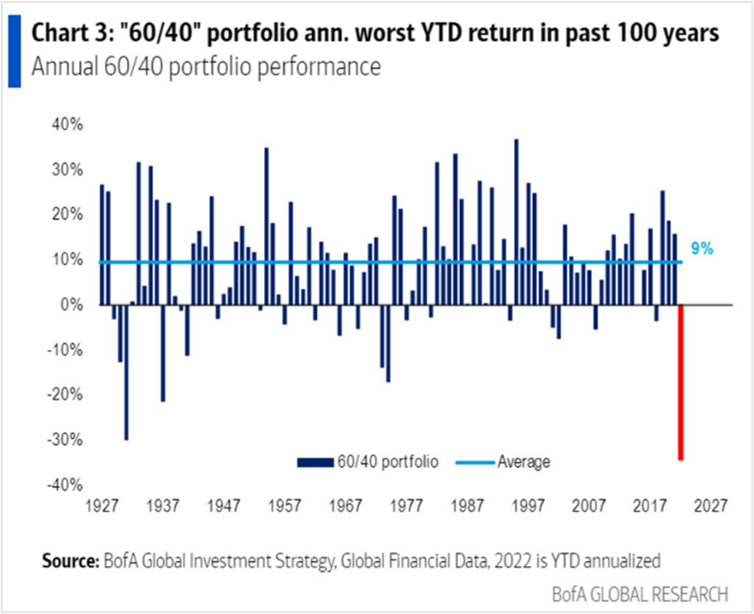

The consistent march towards higher interest rates took no prisoners. Rising rates are a negative for short duration bonds, and even worse for bonds with longer duration – which were hit the hardest as inflation reached levels not seen since the early 1980s. In addition, many growth stocks and speculative companies fell precipitously after reaching nonsensical heights following the deluge of Covid-19 pandemic stimulus, which included central banks flooding the markets with liquidity and reducing interest rates to near-zero levels.

Déjà vu? Yes.

Despite there being almost nowhere to hide in 2022, we’re not pleased anytime we have a negative annual return. However, we have been here before.

In almost every bear market we hear the argument that it’s different this time. While there is no denying the challenges facing economies and markets today, we believe it is important to remind investors – and ourselves – that we have faced similar challenges many times throughout history: world wars, high interest rates, high inflation, technology bubbles, real estate bubbles, debt defaults, double digit unemployment, corporate scandals, and multiple bear markets.

One thing all crises have in common is that they end. Another is that they always unveil compelling opportunities. And we’ve historically done some of our best work during periods of elevated market volatiility and after market declines.

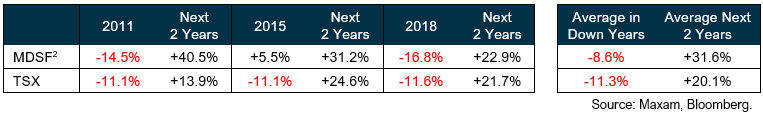

Since the inception of the Maxam Diversified Strategies Fund in 2009, the S&P/TSX Composite Index (the “TSX”) has had three negative calendar year returns besides 2022. Per the table below, our fund was down in two of those years, and positive in one.

During each of these previous market declines we took advantage of attractive investment opportunities. And each decline also represented an opportunity for our investors. The fund’s returns over the next couple of years were very strong. History doesn’t always repeat exactly, but it often rhymes.

Today, like 2011, 2015 and 2018, we believe we have attractive value in our current holdings, and we are excited about the opportunities we are taking advantage of.

Exposures.

As at the end of the quarter, the fund was invested across all 11 industry sectors with no sector weight larger than 20% of net exposure (excluding arbitrage). From a strategy perspective, the fund is invested in long positions where we believe we have identified value and catalyst, as well as special situations, arbitrage, and short investments.

Notable positive contributors to fund performance during the fourth quarter included H20 Innovation Inc, Vecima Networks, Chemtrade Logistics, Guardian Capital Group and TransAlta Corp. Individual holdings detracting from results in the quarter included Nutrien Ltd, Polaris Renewable Energy and Winpak Ltd.

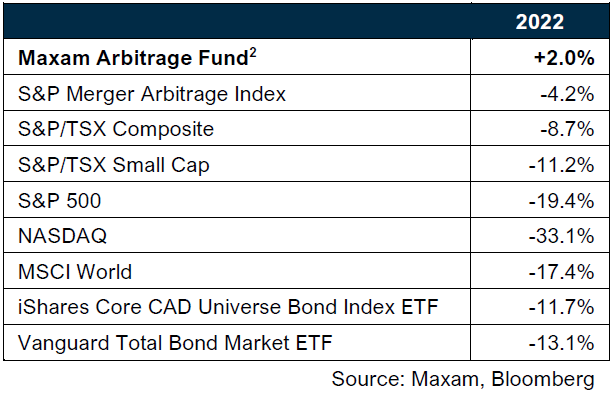

The fund’s arbitrage strategy, 31% at year end, was a positive contributor to fund performance in 2022. This market neutral strategy demonstrated its value as a low-risk source of returns with low-correlation to traditional equities and bonds3.

During the fourth quarter we reduced short exposure from 13% to just under 3% – taking some profits and acting to increase the fund’s net exposure, excluding arbitrage, to 81% at year end.

We expect to continue to increase the fund’s net exposure as we selectively take advantage of compelling value and special situations-oriented investments in the current market environment.

The shift is just getting started.

In recent communications we have been highlighting our view that the market is in the early stages of transitioning away from an environment that has favoured high-multiple, growth-at-any-price, speculative stocks – towards an environment where companies with current and tangible revenues and growing bottom lines will be increasingly rewarded.

The current market structure and set-up reminds us of the post-technology stock bubble period between 2001-2005. During this period, value outperformed growth, and small/mid-caps outperformed large caps – there was a stealth bull market beneath the surface of the bellwether indices which didn’t really go anywhere. We are beginning to see the onset of similar dynamics over the last few months.

Part of this shift is being driven by many of the previous market leaders becoming overvalued or overbought and no longer representing attractive investments. And perhaps equally as important and consequential, is that capital has a cost again – which should bring some rationality back to valuations. This is not good news for the former high-flying growth darlings that relied on easy money to fund their losses and prop up their stock prices (many still remain unattractively valued today in our opinion). Conversely, it is good news for companies with solid balance sheets and positive bottom lines, that are trading at attractive valuations.

While a single month should not be extrapolated into the future, the fund finished 2022 on a positive note, gaining +0.7% in December whereas the S&P/TSX Composite, S&P500 and NASDAQ Composite declined -5.2%, -5.9% and -8.7% respectively. Perhaps some of the above dynamics at play.

Said it once before but it bears repeating now4.

In our Q3 commentary we wrote that: a challenging and shifting market environment always delivers and unveils compelling opportunities. With security prices down significantly, it has most certainly become a more fertile investment environment.

We don’t want to diminish today’s challenges, but we’re mindful that throughout history successful investors have prospered through selective and opportunistic buying during bear markets. We believe that market volatility will remain elevated in the near term and that investors will remain broadly cautious and prone to emotional decisions – this is a recipe for opportunity.

And, as we showed in the table above, we have historically done some of our best work during periods of elevated market volatility and after market declines. This is an attractive environment for our investment style and strategy in our opinion – one that we believe increasingly favours our value-oriented and active approach.

We are excited about the prospects for 2023 and beyond – as much as we have been in several years.

Thank you for your trust and confidence. Please don’t hesitate to reach out with any questions.

Sincerely,

Travis Dowle, CFA

President & Fund Manager

Maxam Capital Management Ltd.

1 Maxam Diversified Strategies Fund, Series F, net of fees and expenses. Please contact us regarding other classes of fund units or visit our website www.maxamcm.com

2 Maxam Diversified Strategies Fund, Series X, net of fees and expenses. Series X is displayed in this table because it represents the funds oldest class of units. Please contact us regarding other classes of fund units or visit our website www.maxamcm.com

3 Arbitrage is a low-risk, consistent and absolute return-oriented strategy. We manage the Maxam Arbitrage Fund which focuses exclusively on arbitrage strategies.

4’Said it once before but it bears repeating now’ are lyrics from the 2001 hit song “Fell in Love with a Girl” by the American garage rock band the White Stripes. https://en.wikipedia.org/wiki/Fell_in_Love_with_a_Girl

This information is intended to provide you with information about the Maxam Diversified Strategies Fund and is not an offer to sell or solicit. Disclosed performance is based on Class X, A and F units and is net of all fees and expenses. Inception date for Class X is June 30, 2009; Class A is December 31, 2012 and; Class F is January 31, 2013. The performance fees on Class X units are subject to a 5% annualized hurdle. Important information about the Fund is contained in the Simplified Prospectus and Fund Facts which should be read carefully before investing. Prior to August 24, 2022 this Fund was offered via Offering Memorandum only and was not a reporting issuer. Historical audited financial statements for this period are archived here. The expenses of the Fund would have been higher during such period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Prior to becoming a reporting issuer, the Fund was not subject to the investment restrictions and practices in NI 81-102. Important information about the Fund is contained in the Fund’s Simplified Prospectus, which should be read before investing. This presentation is neither an offer to sell securities nor a solicitation to sell securities. The securities of the Fund are sold only through IIROC registered dealers in those jurisdictions where it may be lawfully offered for sale. Accredited investors or certain other qualified investors may also purchase securities through Maxam Capital Management Ltd in reliance on certain prospectus exemptions available in National Instrument 45-106. Investors should consult with their own investment advisor and obtain a copy of our applicable Simplified Prospectus and Fund Facts documents before investing in the Fund. Investors should seek advice on the risks of investing in the Fund before investing. This document may contain forward-looking statements. These forward-looking statements are based upon the reasonable beliefs of Maxam Capital Management Ltd. at the time they are made and are not guarantees of future performance, are subject to numerous assumptions, and involve risks and uncertainties about general economic factors which may change over time. Maxam assumes no duty, and does not undertake, to update any forward-looking statement and cautions you not to place undue reliance on these statements as actual events or results may differ materially from those expressed or implied in any forward-looking statements made. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Simplified Prospectus before investing. Any indicated rates of return are the historical annual total returns including changes in value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. This document is not intended to provide legal, accounting, tax or investment advice. Please consult an investment advisor and read the prospectus for the Maxam Diversified Strategies Fund prior to investing.